Since the Great Recession of 2008, most central banks around the world resorted to easing policies to stimulate their economies. The Federal Reserve of the United States kept interest rate at virtually zero and launched four rounds of quantitative easing, until the end of 2015 when it raised rates by 0.25%. In 2009, China also implemented its two rounds of massive stimulus known as the "Four Trillion Yuan Stimulus Package", followed by the "Four Trillion Yuan 2.0" in 2012. Instead of restoring growth, expansionary monetary and fiscal policies in China led to a surge in government and business debts, and excess capacity. At the beginning of 2016, the U.S. and China simultaneously changed their monetary policies again. These moves are expected to have a major impact on the world economy and their growth patterns. At a time when the world has not yet recovered from the crisis, to restructure growth patterns is necessary. Policy makers in China now must make hard choices: Will it follow the U.S. model where monetary policy and the financial sector rule the economy? Or will it re-evaluate the role of monetary policy and the relations between financial liberalization and real economic growth, and reform and balance its economy?

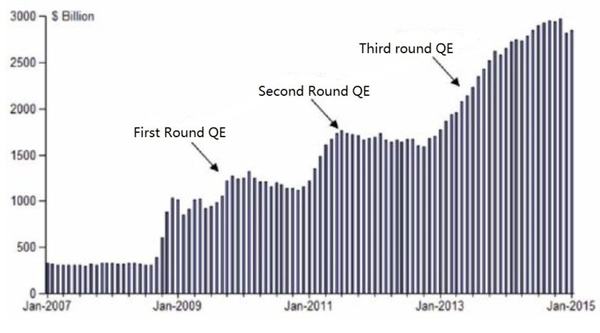

Since the outburst of the 2008 financial crisis, the long-term zero interest rate policy and a series of quantitative easing (QE) in United States had limited successes in boosting its real sector economy[1]. The recovery of real economy in the U.S., coupled with deleveraging in its financial sector, has been sluggish [2] .This is a far cry from what the strongest supporters of the Fed policy asserted. Data showed that most of the liquidity [3] released by Fed remained in the financial system in the form of cash or cash equivalents (see figure below). The excess liquidity did little to real sectors other than raising financial asset prices.

Due to the 7-year expansionary monetary policy, the United States experienced imbalanced development between its financial sector and non-financial sectors, with the former outgrew the latter. Employment didn’t recover until the non-financial sectors began the process of deleveraging and regained profitability. Nevertheless, average income in the U.S. grew very slowly. The imbalance between the financial sector and the industrial sector widened the wealth gap in the U.S. In short, the monetary expansion may have planted the seed for another crisis.

Policy makers of the Fed decided to raise interest rates based on “evidence” of the drop in unemployment rate and the growth in output. However, we are not as optimistic as the Fed about future U.S. economic performance. This may sound harsh but we think the recovery in employment is “a beautiful lie”. Though the United States did recover from recession lows, the pace and scope of recovery is not satisfactory. With the draw-down of the Fed’s stimulus, the illusion of prosperity created by monetary easing may eventually disappear.

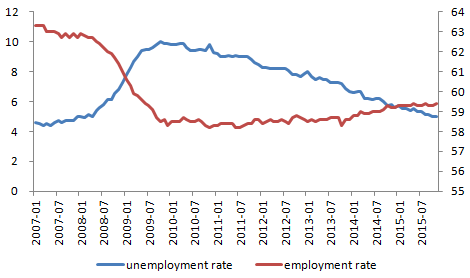

Rising employment is usually seen a sign of economic recovery. According to Fortune Magazine [5], by June 2014, the U.S. labor market regained the 8 million jobs it lost to the financial crisis. Unfortunately, a research from Georgetown University in November 2015 suggested a loss of 6.4 million employment opportunities. Why? Because although unemployment rate dropped to 4.9% in January 2016, this is not sufficient to conclude that the labor market has fully recovered. The U.S. Labor Department’s unemployment data does not count underemployed labor, part-time workers and more importantly, people who stopped looking for work. If we look at employment-to-population ratio (also known as employment rate) [6], it could hardly be argued that the labor market has fully recovered: employment-to-population ratio was 62.8% before 2008, declined to 57.8% during the subprime mortgage crisis and now stands at 59.3%. Considering the changes in this ratio, we estimate the real unemployment rate [7] in the U.S. is between 8% to 10%, which is much higher than the pre-recession average of 5%.

Data from: Wind Database

In addition, along with the drop in labor participation rate, income growth of American workers has been slow, which restricts the momentum of consumption-dependent U.S. economy. In this sense, it may be too early to predict that the U.S. economy has already recovered from the recession.

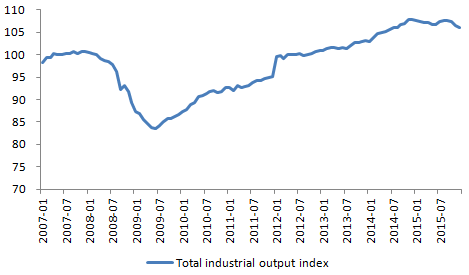

Although the manufacturing industry in the U.S. has been growing for 26 quarters since June 2009, its weakness is evident. Technological innovation, such as the revival of the manufacturing industry [8], the rise of 3D printing technology [9] and the shale gas revolution[10], were expected to bring its manufacturing industry back on its feet. Nevertheless, the strong reliance on financial economy [11] and excess liquidity crowded out the real economy, impeding growth of the manufacturing sector. We estimate that a cyclical recession of the U.S. economy will occur in 2016. Growth rates of the U.S. manufacturing and sales have been decreasing since January 2015, new orders started to drop since Nov. 2014, and inventory level grew steadily. All these facts show that declining demand in the U.S. manufacturing industry. The ISM Manufacturing Index [12] fell to 48.6, the lowest December level in recent history. Thus, we estimate that the overall U.S. manufacturing sector is likely to experience a slowdown in 2016. Although the manufacturing industry only accounts for 12% of the U.S. economy, its weakness can negatively affect the recovery of the service sector.

Data from: Wind Database

In an article published by wallstreet.cn in January named Under Global Turmoil, Can America Survive This Time, economist Shijiao Wang argued that the severe drop in oil prices might result in a huge shock to the U.S. market, similar to the internet bubble burst in 2000. By 2014, energy investment of large U.S. companies accounted for 2.3% of the U.S. GDP, a percentage twice that of the telecommunications, media and the science industry combined in 2000. The burst of internet bubble sent the U.S. economy into a recession. Although currently the burst of shale gas sector may not cause an overall recession to the entire economy, it is definitely a cause for caution. The scale of junk bond market increased by 80% to 1.3 trillion U.S. dollars since the Fed implemented QE in 2009, where energy junk bond increased by 180%, surpassing 200 billion dollars. Since the Fed released signal of ending QE in mid. 2014, the U.S. dollar has been appreciating and oil price falling. Some firms investing in shale gas is facing insolvency. If low oil prices last for another 6 months, the shale gas bubble may increase significantly.

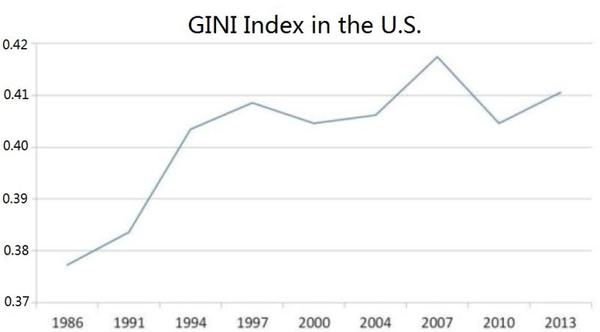

Although this problem may not lead to essential changes in the short-term, the shrinkage of the U.S. middle class caused by further expansion of wealth gap is likely to exert a negative influence on consumption, the core of the U.S. economy. The proportion of middle class families decreased from 61% in 1971 to 49.4% in 2015, which indicates that the population with the strongest purchasing power is no longer the majority in the United States. The purchasing power gap between the rich and the poor erodes the foundation of consumption. The bubbles in financial sector and real estate sector, the long-lasting economic downturn, the recovery without comprehensive employment and the imbalance of labor supply and demand resulted in the deteriorating situation in wealth gap. The figure below by World Bank shows the tendency of Gini coefficient [13] of the United States:

We believe there is a widening of wealth gap each time a financial bubble forms [14]. Increasing income inequality affects not only social justice but also economic growth. Occupy Wall Street movement since 2011 encapsulated a popular sentiment towards Wall Street greed and excessive risk-taking in the financial sector.

To sum up, household income growth is not satisfactory to many Americans and previous growth engine is weakening. U.S. economy has a long way to go until a full recovery.

China’s economy will slow down significantly in the short term. It is neither possible nor wise for China to retain its GDP growth rate of 7% or above in the next couple of years. China has experienced a rapid expansion for almost thirty years, resulting in severe structural imbalances and resource mismatches that render its growth model unsustainable. The traditional growth pattern has run out of gas, and it is impossible for China to keep high GDP growth rate solely through government-led investment and export. In 2015, we expressed reservations about China’s economy, and we argued that neither fiscal expanding nor monetary expansion would help with growth. Fortunately, in November 2015, Chinese policy makers proposed a supply-side reform, which raised our hopes for the future. If China adjusts its macroeconomic structure and abandons the old path of growth, it still has large growth potential, although a short term slowdown is inevitable.

The economic structure should be adjusted as soon as possible, and how to do that is the first question that policy makers in China must tackle in 2016 and beyond. The structural imbalance is the most thorny issue facing the Chinese economy. Over reliance on investment and excessive liabilities are not sustainable and weaken economic vitality. At the same time, the old model severely strained resources and the environment. The conventional macroeconomic policies in China, mainly focused on the demand side, can only have short-term effects and are superficial. It is these policies that caused the structural problems in the first place. They reduced the quality and efficiency of economic development, eroded the basis of sustainable growth and increased the risk of the economic system.

We do see some positive changes though. Some adjustments which seem to be ordinary are indeed very important to show the improvement of China’s economic reform. First, consumption in China has geared towards more individual and personalized consumption; Secondly, investment is becoming more diversified in terms of industry and ownership. Unified industrial investment following policies in the old times has been less; thirdly, the adjustment of income distribution, led by the improvement of social welfare system, has been accelerating; lastly, the importance of protecting the environment is recognized with red line set for previously heavy-polluting industries. Because of these four adjustments, the economic vitality may be incrementally released, and China’s economic growth patterns may see a “turning point” soon. According to statistics, China’s service industry has surpassed the secondary industry and became the largest component of the GDP. It is expected to lead economic growth in the future.

Data from: Wind Database

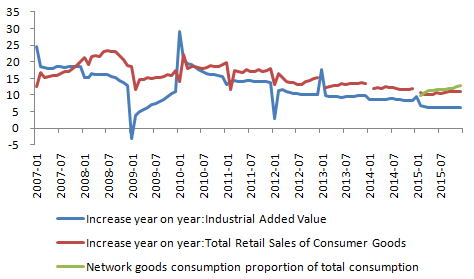

In 2016 the engine of China’s economic growth will shift. We believes that the industrial value added (IVA) will increase due to short-term periodical variation of inventory, but it cannot be the main force of economic growth. Investment will remain at a low level, and consumption will play an important role. Considering the IVA in 2015, the value added of high-tech industry keeps increasing, whereas that of traditional industry keeps shrinking. We believe that this trend will be clearer in 2016. Because excess capacity industries takes up a large proportion in the total industry, and the market clearing of excess capacity cannot be finished within a short period of time, their persistent shrinking will result in a lower growth rate of total IVA, even though high technology industry grows rapidly. The overall industry’s performance will remain weak in 2016, where the fixed asset investment will get a lower growth rate, and the infrastructure, real estate and industrial investment is also likely to be weak. By contrast, consumption will make a larger contribution to economic growth. China has already showed strong consumption potential. For example, Alibaba generated 91.2 billion RMB (around 14 billion dollars) sales on China’s “bachelor’s day” of November 11 last year. The amount is close to the overall sales of 107.9 billion RMB (including network selling and entity selling, around 16.6 billion dollars) during America’s “black Friday” shopping. Adding the sales of Netease, Tencent, JD and other online shopping businesses, the overall sales surpassed that of “Black Friday”. Although the total annual consumption of China is lower than that of the U.S., the explosion of the consumption capacity indicates that a period of individualized consumption is coming.

Data from: Wind Database

It is well known that production relies on three factors, capital input, labor input, and technology. The structure of production (institutional design) is another factor. When the factor inputs and technology remain unchanged, the institutional arrangement has a significant impact on the economic output. For example, after the household contract system reform, income distribution between landowners and farmers became incentive-compatible. Without adding more input or adopting new technology, the agricultural sector grew exponentially. The structural reforms in progress, such as state-owned enterprise reforms, tax revenue reforms, and land reforms, are expected to be as important as the household contract system reform, in which the production factors remain the same but the productivity increases. Structural reform is a very complex issue, which involves hot-button issues such as such as redistribution of interests. It would be difficult to make great progress in the short run. Regarding innovation, it is natural that there is a time lag between innovation and mass application. Therefore, we do not expect China’s economy will return to high speed growth in the short-run. However, we argue that reforms of this kind, such as fiscal reforms, government investment and financing reforms and state-owned enterprise reforms, are critical and urgent. It treats the root cause of the problem. In addition, more emphasis should be placed on the increase of total factor productivity, as it improves the quality of the economic growth.

Over-emphasis on financial sector distorts the common sense on wealth creation. Regarding the outlook for Chinese economy in 2016, we think that two risks exist, “internet financing” and “popular finance”. First of all, China holds around 1 trillion U.S. dollars of foreign debt. This can be a potential risk if the dollar appreciates or RMB depreciates. However, much larger risk lies domestically. In the circumstance of demand-side economic policies, lots of economic problems have been accumulated, due to high liabilities, high leverage and over investment. Meanwhile, this type of policies has aroused the biased acknowledgement of finance and financial development. Now in China, almost every individual and enterprise wants to take part in financial activities, especially those Internet-based companies. However, this popularity generates financial risks, since not everybody understood the risks behind finance. Most of the state-owned enterprises in China have experienced losses in core business. Their profits mainly come from non-core business such as finance. This tendency is alarming, because financial risks can spread into the real economy. In addition, if China’s economy developed into the stage of “popular finance”, it would weaken the real economy, since resources were diverted to a sector whose wealth creation comes largely from the real sector.

“Internet Financing” increases potential risks. Internet is a natural outgrowth of technological advancement. However, the network technology is similar to steam engine, internal combustion engine and electricity. It is a means by which productivity can improve dramatically. The improvement of efficiency relies on how we use these tools. We should not put too much faith into a tool itself. Instead, we should pay attention to the mechanism and methods on how to use the tools properly. Regarding the combination of internet and finance, the priority is to understand the value of finance by reducing information asymmetry in capital allocation and improving capital efficiency. Secondly, the core of “internet financing” is to use advanced technology to collect credits, make analysis and credit evaluation, in order to improve efficiency and reduce risks, with the help of big data and cloud computing. When understanding these basic points, internet financing companies have to collect data and information through some platforms such as e-business, social network and search engine. This is a long-term progress. The Alipay chooses this development routine, so are the Alipay wallet, Ali small loans, network banks and many other Internet financing products. However, it should be emphasized that the simple combination of Internet technology and finance is a “mine field”. The P2P model is a typical example. Since P2P was introduced into China in 2007, it has developed into the most important category of “internet financing”. Since 2014, a large amount of capital has been invested into the P2P, due to the frenzy from capital market and P2P’s own character of attracting money. Most of the P2P companies do not have big data management or cloud computing. They are engaged in illegal activities, such as usury and fraud, concealed behind the Internet. On the other hand, most of the people who are involved in P2P lack basic financial knowledge. Their capacities of collecting and dealing with information are different as well. As a result, the P2P is far more than simply a “direct financing platform for Internet users” defined by the central bank. It has indeed become “network banks” to collect money illegally, without financing licences, required reserves, LDR (loan-to-deposit ratio) limit, deposit insurance or any internal control system. The story of “fanya” and “e zubao” are such examples.

We have reservations about the effects of QE policies though we understand the difficult situations the Fed’s in. Based on the reaction of capital market and the real economy, it is unfitting for the Fed to raise interest rate further (at least in 2016), although Chairwoman Yellen announced that the Fed will keep tightening this year. We believe that, even if there might be another rate hike, it would come rather late, and most likely after the presidential election. The reasons are as follows. First, the recovery of the U.S. economy is actually not strong, as mentioned before. Although the Fed announced that its policies have returned to normal, based on the “fact” that the U.S. economy has revitalized, such assessment is doubted by economists. The U.S. financial sector has been doing well, but if high interest rate jeopardizes the real sector, financial sector may suffer even more. Second, ever since the Fed cut its 85 billion dollar bond purchase, the era of monetary expansion has ended. However, the financial sector did not react to this change promptly, leading to accumulations of investment risks and formation of bubbles (such as the American junk bonds market). Under the circumstances that so many mal-investments are in the market, the Fed will suffer from more handicaps while raising interest rates. Third, the globalization has made the world more integrated than ever, which can influence the interaction of monetary policies among countries in a more profound way. If Fed’s monetary policies contradict those of other major economies significantly, they may in turn also impede America’s economic recovery.

Since China’s government launched the “Four Trillion Yuan Stimulus Package” in 2009, we questioned the proposal and were concerned about the negative outcome that it may bring. We advised the regulators to undertake structural reforms rather than resort to fiscal and monetary stimulus. But our calls went unheeded. Now we emphasize again that expansionary monetary policies do more harm than good. We believe that abuse of monetary policies will distort common sense on growth creation, and even interfere with our direction of advancement, though we realize that these opinions may lead to conflicts of interest. Monetary easing can help protect the economy from deteriorating in the short run, but it has decreasing marginal effects and has many side effects. Money is not omnipotent.

Although the Chinese authorities announced that they would maintain a prudent monetary policy in 2015, they announced interest rate cuts six times and lowered requirement reserve ratio five times. These two measures were simultaneously carried out twice[19]. At present, China’s one-year benchmark deposit rate is 1.5%, which is a historic low. And the real interest rate is approximately 0 if we take the current inflation rate of 1.5% into account. Therefore, we can hardly call this policy prudent. Nevertheless, China’s policymakers have proposed the “Supply-Side Reforms” for many times since November, 2015. President Xi Jinping says that “Monetary policy alone is far from enough to solve the problems of the world economy. What we should resolve to make efforts in boosting structural reforms of the market, upgrading the supply-side to meet the change of demand-side.” Indeed, the current macro-economic data shows that the fixed asset investment as a proportion of GDP has exceeded 45%, marginal return of investment, measured by the ratio of new GDP over additional investment, has declined gradually. Keynesian way of thinking makes no good to China’s economy. If China continues to stimulate its economy by deficit spending and increasing money supply, it may fall into a liquidity trap.

We advise that China’s central bank not cut interest rate any more. This might hurt some troubled industries, but pouring more money to them only makes matters worse. Moreover, it is more important for the central bank to maintain the stability of the exchange rate at the moment. Consider that liquidity demand is subject to seasonal or temporary shock, central bank will apply short-term liquidity operations (SLO) or similar instrument to hedge against these shocks.

The choices of economic and financial policies are in essence the choice of development models. In that regard, China is supposed to learn from the lessons of the United States. After the collapse of the Bretton Woods system in the 1970s, based on market fundamentalism theories, including “Reaganomics”, Thatcher Revolution and Washington Consensus, financial capitalism came into dominance which relies on major drivers of fictitious economy including money market, capital market and commodity market. As the successor of commercial capitalism and industrial capitalism, financial capitalism is now ruling the U.S. Quantitative easing, the typical financial capitalism, was proved to be a failure during the 2008 global financial crisis. The negative effects of QE will appear over time. To begin with, the sharp increase of money supply directly motivated extra speculation and arbitrage. From October 2008 to March 2010, the first round of quantitative easing inflated commodity prices by 36%, with food and oil prices rising by 20% and 59% respectively. The second round inflated commodity price by 10% with food and oil prices rise by 15% and 30% respectively, creating hidden perils for the slump of oil price since 2014. Secondly, by stimulating the appreciation of asset prices in the stock market, QE expanded the deviation of fictitious economy from real economy, deteriorating the structure of income distribution and increasing the wealth gap. Thirdly, QE severely distorted the economic system’s endogenous regulation mechanisms, especially the mechanism of price regulation. Fourthly, the massive liquidity released through QE created potential danger of serious inflation.

Four possible reasons may explain the failure of quantitative easing: 1) QE confounded money with credit, and it tried to fool the market that they are equivalent. 2) QE was implemented on an assumption that the expansion of liquidity flows into real economy. 3) Policy makers mistakenly used monetary expansion as a direct impetus to income increase. 4) The policy failed to notice that the expectation of inflation can restrain investment.

Rescuing the economy with financial measures was a rash decision. Right after the 2008 global financial crisis, central banks became the savior of the economy, ignoring that they were the culprit of the crisis in the first place. They have been using their “panacea”, i.e. pouring fiat money into financial institutions. The 7-year QE fail to save financial capitalism but caused a series of additional troubles, such as more deviation between fictitious economy and real economy, the expansion of wealth gap, the continued regional volatility and the drastic fluctuation of asset price.

The influence of financial repression is becoming increasingly significant. The largest risk of the U.S. real economy lies in the crowding-out effect caused by the financial sector. According to traditional theories, financial development has positive impact on real economy, for the former provides financing convenience and improves the capability of integrating resources of the latter. Nevertheless, with financial liberalization and, most vitally, the excessive monetary supply by Fed, the financial industry showed strong “search for yield” effect that, in order to maintain the desired rate of return, they become more risk taking. Asset price appreciated as a result of this preference change and abundant liquidity, making financial investments much more profitable than investments in real sector. In this way, resources were diverted into the financial sector, and real sector were repressed. This reminds us the formation of housing bubble in the United States during 2001 to 2006 when Fed implemented a 3-year ultra-low interest rate. To make up for the loss by the burst of last bubble, Fed is creating (or has created) a new one.

China has been following the United States for too long. Its real economy, after two rounds of strong stimulus known as the "Four Trillion Yuan Package", has generated severe excessive capacity. Policies by China’s central bank since late 2014 showed that China has been following the U.S. again by repeating what Fed did in 2008: money was kept within the financial sector, less and less credit was created in the real sector, asset prices appreciated significantly (where stock market, real estate and bond market boomed and bust one after another). The central government did not realize that deleveraging is urgent until the end of 2015.

A healthy balance sheet is the prerequisite of economic growth, and de-leverage is necessary for real recovery. Although China has proposed the reform of deleveraging, data show that the process has not started yet. Once it takes essential actions to deleverage, economic growth will slow down further. Leverage up or deleverage too slowly in real sector causes larger cost and more difficulty in raising external finance, because it increases the risk of borrowers’ default. In this way, money stops to enter to the real sector and will be kept in the financial sector. The frustrating balance sheets of the real sector add more motivation for financial sector to speculate and arbitrage money in fictitious economy, accelerating the formation of asset bubble. Meanwhile, as money is reluctant to flow into the real sector, when one bubble bursts, money goes to another financial target and a new bubble begins to inflate.

China must choose a new path for its economic development rather than following the U.S. The Chinese had a tradition of learning from history and past experience. With the existing models having limited success in sustaining growth, China needs to establish a new model. With challenges and risks, global economic recovery remains sluggish. Only a few countries dealt with their economic problems effectively, while many did not address fundamental issues facing their economies. With the economy held hostage by the financial sector and monetary policy, most economies get mired in the old model, namely, the Keynesian model. By the end of 2015, China’s policy makers finally proposed structural and institutional reforms. We believe that if such reforms are carried out, despite problems and risks in the short run, the Chinese economy stands a better chance of getting back on track and sustaining strong growth.

[1] Refer to the non-financial business in general, versus fictitious economy.

[2] Debt write-down and bankruptcy

[3] Liquidity can be regarded as currencies equivalent to the cash

[4] Janet L. Yellen, is now the president of the Federal Reserve. She is the first president after Paul Adolph Volcker, Jr, who has the background of the Democratic Party of the US since the 1980s.

[5] See website http://stock.qq.com/a/20151214/059567.html

[6] The ratio between employed population and the sum of population who have reached the working age.

[7] A comparable unemployment ratio before the crisis

[8] Since the financial crisis erupted in 2008, American president Barack Obama strongly implemented national policies of Re-industrialization and Return of the Manufacturing Industry. In fact, these policies are aimed to review the hollowness of American industries. In order to emphasize the importance of manufacturing industry, American government launched Reviving American Manufacturing Frameworkin December 2009, Advanced Manufacturing Industry Partnershipin June 2011 and Advanced Manufacturing Industry National Strategyin February 2012. In 2013, the government issued Manufacturing Innovation Center Network Development Plan. Projects and programs mentioned above are all about the return of manufacturing industry.

[9] Three-Dimensional Printing (3D Printing) is a kind of rapid prototyping technology, which is based on digital modal files. The 3D printing uses adhesive materials, such as powdered metals and plastics, to structure substances via layers of printing pattern. 3D printing is usually applied to modeling in areas like model making and industrial design, and afterwards, it is gradually used in direct manufacturing.

[10] Generally, Shale technology refers to a kind of unconventional fossil energy technology to exploit petroleum and natural gas, contained in shales, by means of special technologies.

[11] The fictitious economy, relative to the real economy, is a specific price system, which is centered by a way of basic capitalization pricing. Simply speaking, the fictitious economy is a trading system that utilizes assets from the real economy through the way of asset securitization or financialization. Sometimes the trading property even doesn’t need an underlying asset. Virtual capitals, such as securities, futures and options, can all belong to domains of the fictitious economy. They derive from virtual capitals that have credit relationships and developed quickly under rapid development of the credit economy.

[12] It is short for Institute of Supply Management Manufacturing Index, which is an important data published by the Institute of Supply Management (ISM) and influence significantly on prosperity of American manufacturing industry.

[13] The Gini Coefficient is applied to measure how balanced the income distribution is. If there is a perfectly average income distribution, the Gini Coefficient equals to 0. On the contrary, the absolute nonequilibrium happens when all income are distributed to just one person, and the Gini Coefficient equals to 100. The nation’s wealth gap enlarges when the Gini Coefficient increases.

[14] From 1991 to 1997, from 2001 to 2007, from 2010 up to now.

[15] Demand-side policies such as economic growth maintenance and easy monetary policies.

[16] A strengthened momentum for the economy to develop itself instead of monetary and fiscal policies.

[17] Consumption goods are similar to each other, the only difference is consuming quantities.

[18] To obtain information much more conveniently, accurately and inexpensively.

[19] To decrease the interest rate and to cut the required reserve ratio (RRR) simultaneously.

[20] Fiat money is a kind of banknotes that are accepted legislatively on the level of nations. At the time of Gold Standard and The Bretton Woods System, national currencies linked up with the gold in a direct or indirect way, which can be called anchor currencies. The issue volume of the anchor currencies is restricted by the gold reserves. After The Bretton Woods System broke down, currencies of each country became the fiat money, which can be excessive at will, influenced by monetary policies of themselves.

—————————————————————

FOCUS ON CONTEMPORARY NEEDS.

Should you have any questions, please contact us at public@taiheglobal.org